Payworld Shortlisted as One of 34 GST Suvidha Providers

Introduced by The Constitution (One Hundred and First Amendment) Act 2016, Goods and Services Tax (GST) is a proposed system of indirect taxation in India merging most of the existing taxes into single system of taxation.The taxes which will be subsumed into GST include central excise duty, services tax, additional customs duty, surcharges and state-level value added tax.

To bring about a uniformity and functionality regarding GST in the nation, the Government has come up with GSP concept. GSPs are basically GST Suvidha Providers that will help as a link between vendors and GST. In simple words, third party IT vendors who develop web or mobile based interfaces for tax payers to interact with GST network are called GST Suvidhaa Providers or GSP. The task of GSP is to provide convenient ways to the taxpayers in interacting with GST system starting from registration of entity to uploading of invoice details and going up till the filing of returns.

GSTN (Goods & Services Tax Network) is tasked with building the biggest ever and a complex tax network for India, and for that they have shortlisted 34 companies to act as GSP, of which Payworld- one of India’s leading utility services providers- is the one.

Praveen Dhabhai, COO of Payworld said "We are very proud to be a part of the biggest tax reform in the world. GST by magnitude is the biggest tax reform that India and the world will ever witness. GSPs will play a crucial role in bridging the gap between the tax payers and the GST system, which is set to become the world’s biggest and perhaps most complex tax framework."

Owned by Sugal and Damani Utility Services Private Limited, Payworld is a preeminent electronic processing platform for financial transactions. As GSP, it will acquire and provide solutions to small merchants and vendors in order to help them comply with GST regime.

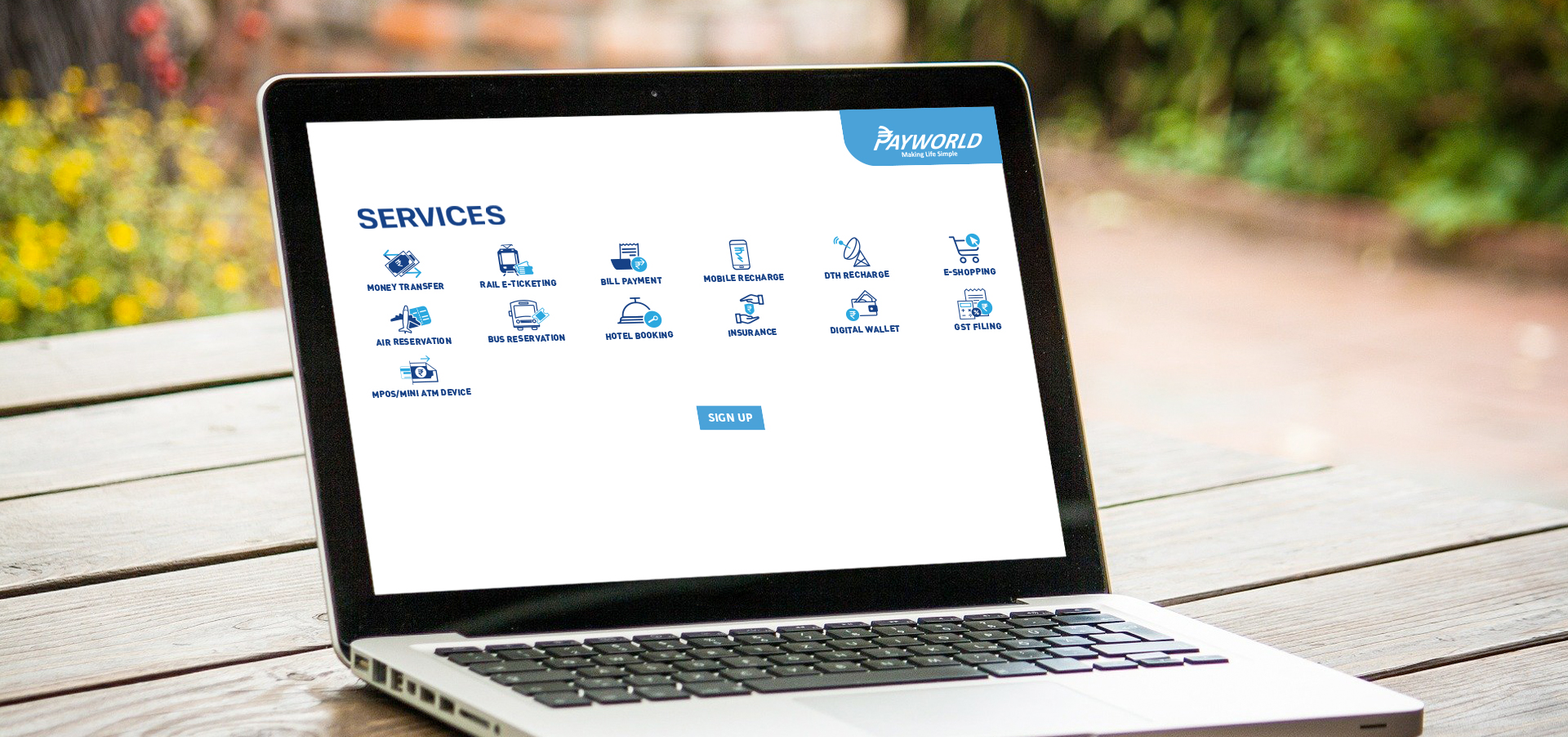

Under its platform, Payworld offers utility services to its consumers in terms of domestic money remittance, mobile and DTH recharges, rail, air and bus reservation and utility bill collections, digital wallets, cash withdrawal points and assisted e-commerce.

Payworld's 100 per cent subsidiary, Payworld Money (Smart Payment Solutions Pvt. Ltd.) offers a mobile wallet that is an excellent option for non tech-savvy smart phone users to go cashless.Payworld Money is an RBI approved pre- paid instrument (PPI) - digital/ mobile wallet) issuer which has users doing primarily domestic money remittances through the assisted mode.