Online Money Transfer. Dare to put away the Scare!

The online money transfer business has witnessed a massive growth in the past decade globally. India’s domestic remittance market alone has grown consistently at a CAGR of 10.3% in the years 2008-2013, as declared by the NSSO – National Sample Survey Organisation. Both rural and urban areas in India have seen large scale transfers being sent on a regular basis with some rural household actually surviving on money transferred by domestic migrants. Be it online bill payments, NEFT transactions or remittance transfers, the convenience and speed of online transfer has a majority of the population using their laptop or mobile for all banking purposes. As per the survey, over 17 million subscribers use their smartphones for banking transactions in India.

This unprecedented rise has given way to several business correspondents in the nation offering domestic remittance transfer services. Until a few years ago, the domestic remittance market was largely controlled by informal channels such as post offices, with a market share of almost 70% in 2008 (Source: NSSO).However, increased access to technology and rise in out-migrant population transferring money online, has led to a steady shift from informal to formal channels in the past 5 years. The involvement of banks and business correspondents in this arena has led to quicker, safer and hassle free transfers, thus cementing their place in the industry.

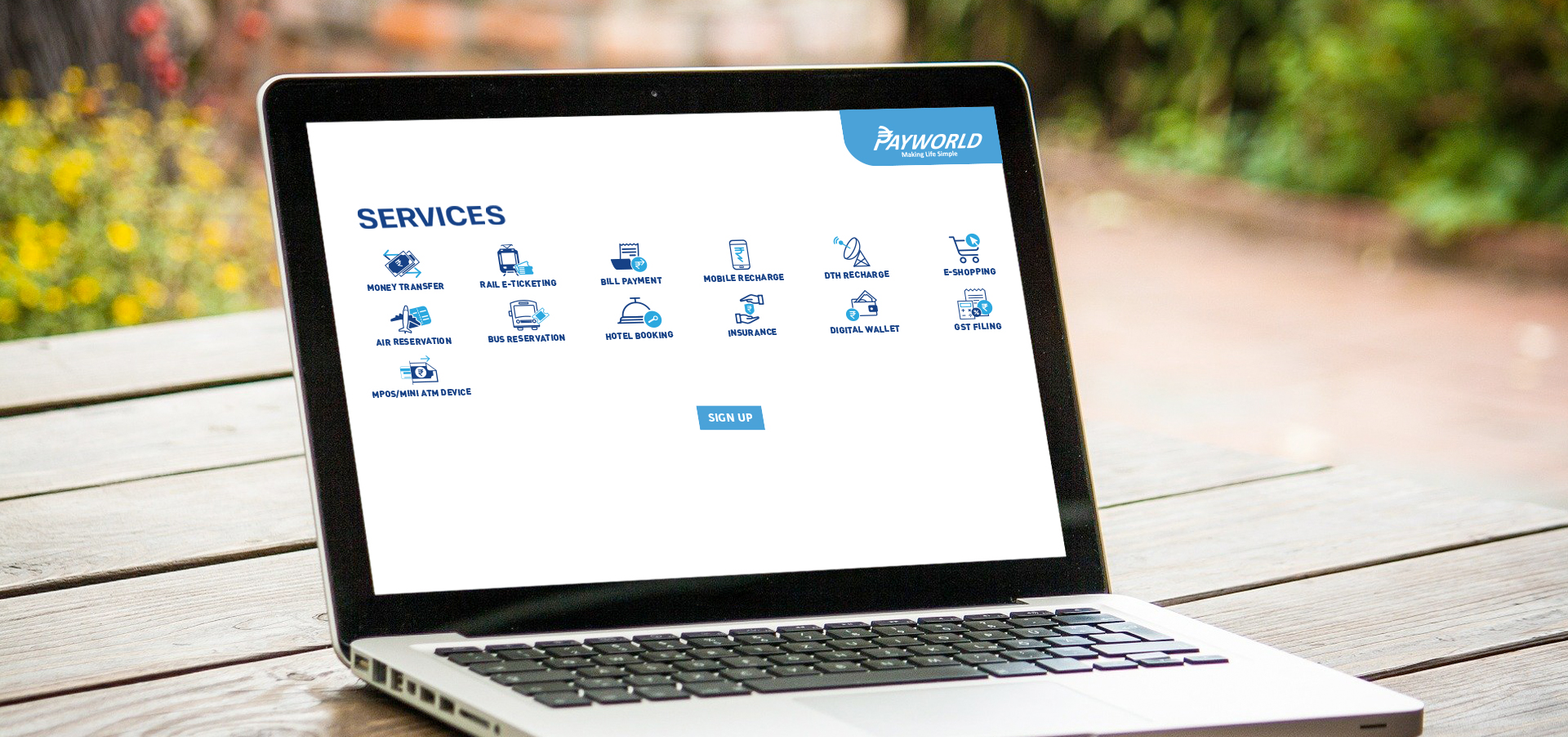

One such revolutionary solution is offered by Payworld India in partnership with Yes Bank. Their Domestic Money Transfer Service offers customers a secure and easy option to transfer funds online. A customer simply has to register himself by visiting Payworld retailer and on approval can instantly begin to transfer money. Further, continuous SMS alerts allow customers to track their transfers from the initiation stage till they are received in the final account. In case of any issue, the customer simply needs to contact the business correspondent agent. (Payworld retailer)

Also, for added convenience Payworld offers you 2 options to transfer money online. Customers can opt for the IMPS mode (available 24*7 with funds transferred in 3 seconds flat) or the NEFT transfer (funds transferred during bank hours only without the option of bank holidays), based on the service availability with the bank being used.

Now you can simply transfer money from the convenience of your home without waiting in long queues. Visit any Payworld retailer’s outlet and transfer funds to your loved ones as and when you require in a secure and easy manner.

Also, for added convenience Payworld offers you 2 options to transfer money online. Customers can opt for the IMPS mode (available 24*7 with funds transferred in 3 seconds flat) or the NEFT transfer (funds transferred during bank hours only without the option of bank holidays), based on the service availability with the bank being used.

Now you can simply transfer money from the convenience of your home without waiting in long queues. Visit any Payworld retailer’s outlet and transfer funds to your loved ones as and when you require in a secure and easy manner.

Also, for added convenience Payworld offers you 2 options to transfer money online. Customers can opt for the IMPS mode (available 24*7 with funds transferred in 3 seconds flat) or the NEFT transfer (funds transferred during bank hours only without the option of bank holidays), based on the service availability with the bank being used.

Now you can simply transfer money from the convenience of your home without waiting in long queues. Visit any Payworld retailer’s outlet and transfer funds to your loved ones as and when you require in a secure and easy manner.

Also, for added convenience Payworld offers you 2 options to transfer money online. Customers can opt for the IMPS mode (available 24*7 with funds transferred in 3 seconds flat) or the NEFT transfer (funds transferred during bank hours only without the option of bank holidays), based on the service availability with the bank being used.

Now you can simply transfer money from the convenience of your home without waiting in long queues. Visit any Payworld retailer’s outlet and transfer funds to your loved ones as and when you require in a secure and easy manner.