The world of Payworld

With the advent of internet in India, the monetary payment structures have been revolutionized within the nation. We have reached a point where you as a consumer or a producer are able to conduct monetary transactions without stepping out of their house. Even private players are entering the market, offering more user friendly services. Newly formed companies like Payworld have now grown over the years to offer multiple solutions across various platforms for maximum efficacy. But what has been the secret of this rapid growth, one might wonder. Let us embark on a journey to find out how, exploring the jungles through the lens of Payworld.

In the year 2007, Sugal and Damani Utilities Services Pvt Ltd. started functioning as an independent entity from its parent company, and the world witnessed for first time the convenience and liberty of prepaid top-ups and recharges with Payworld hitting the commercial business space.

We all remember the days where running around for a prepaid phone recharge was a well accepted norm. There would be brand specific retailers and locating a retailer that matched your telecom service provider was always a hassle. But with the beginning of the internet era in India, things were to change forever. It was around the same time that Payworld began beta testing its entire systems. By June of 2007 Payworld was successfully providing both mobile and Direct to Home (DTH) recharge options. Using a single platform, retailers now had the option of providing multiple recharge options at one place. The fires of change usually begin with small sparks.

In the year 2008, Payworld entered into transport reservation services (Air, Bus, and Rail). One of the pioneers in its field, Payworld has forever stood firm with its motto of “Making Life Simple”. This led to successful partnership with the governments’ National E Governance Programs. With the course of time, Payworld defined its’ niche and with that came the style of working. Soon Payworld Solutions became known for improving operator’s efficiency, generating extra revenue for the retailers and associates, and providing better and convenient services to the customers.

By end of the decade, the country was changing in a fast pace. Broadband connection where spread across the nation. But by this time a new phenomena was catching everybody’s interest. This wireless mode of communication was soon to change the entire telecommunication sector in India. It was the Mobile phone. With around 300 million wireless phone subscribers by the year 2009, there was a need to provide similar services on a mobile platform as well. And so in the early spring of 2009 Payworld launched its services on a mobile platform as well.

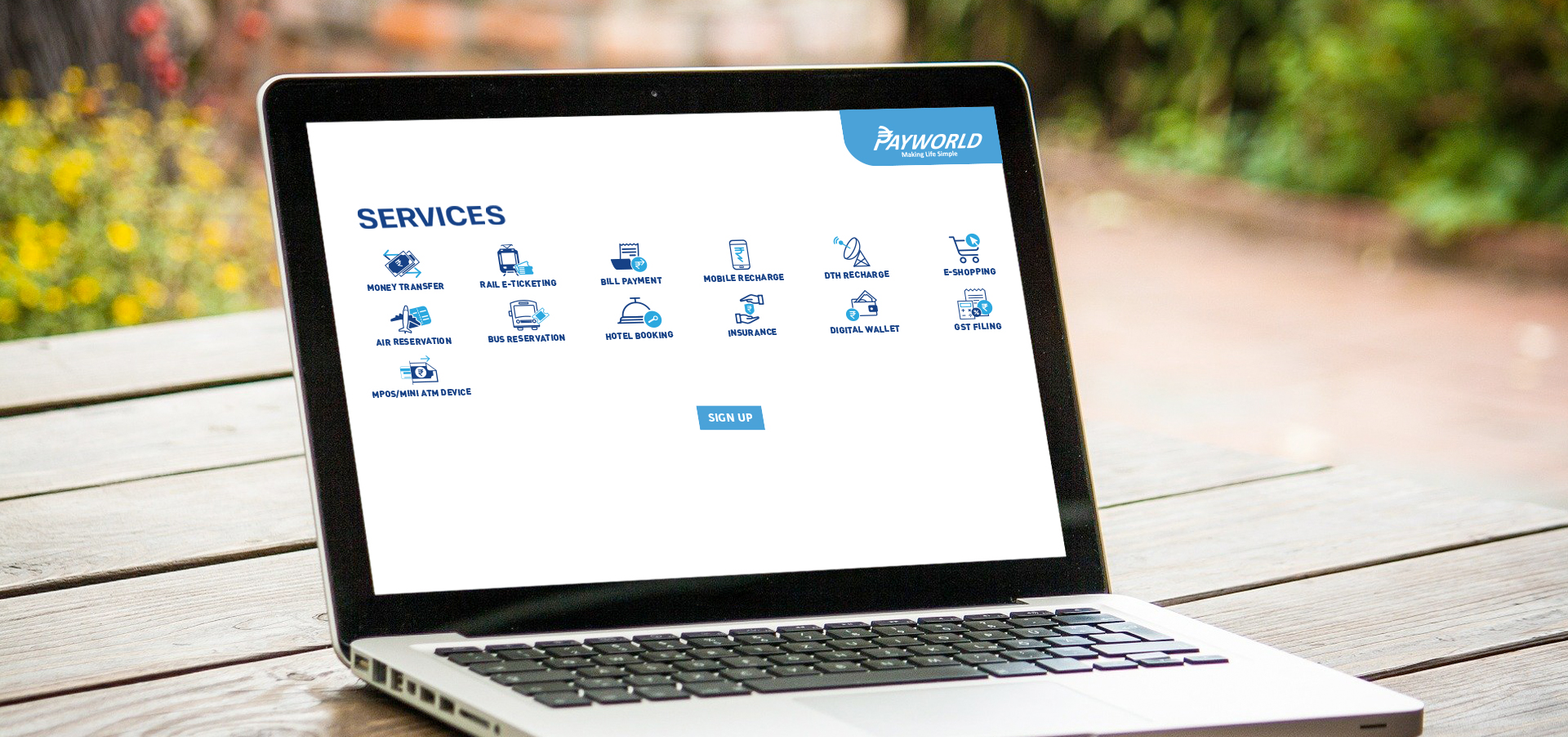

Payworld now stood at a position where the quality of its products and services spoke for themselves. With an outreach in about 630 cities in 23 states in India, Payworld’s solutions were able to build its own significance in the technological domain of electronic voucher distribution system and thus portrayed an ideal business model leading to prosperity and convenience. Along with the EVDS and the e-booking of transport services, it now provides a plethora of utility services to its consumers with Domestic Money Remittance, Utility Bill collections, Digital Wallets, Cash withdrawal points and Assisted e- commerce, all through one simple and user friendly application. An application which runs on desktops , laptops and mobile phones using Android, Windows, iOS & Java platforms.

In the year 2008, Payworld entered into transport reservation services (Air, Bus, and Rail). One of the pioneers in its field, Payworld has forever stood firm with its motto of “Making Life Simple”. This led to successful partnership with the governments’ National E Governance Programs. With the course of time, Payworld defined its’ niche and with that came the style of working. Soon Payworld Solutions became known for improving operator’s efficiency, generating extra revenue for the retailers and associates, and providing better and convenient services to the customers.

By end of the decade, the country was changing in a fast pace. Broadband connection where spread across the nation. But by this time a new phenomena was catching everybody’s interest. This wireless mode of communication was soon to change the entire telecommunication sector in India. It was the Mobile phone. With around 300 million wireless phone subscribers by the year 2009, there was a need to provide similar services on a mobile platform as well. And so in the early spring of 2009 Payworld launched its services on a mobile platform as well.

Payworld now stood at a position where the quality of its products and services spoke for themselves. With an outreach in about 630 cities in 23 states in India, Payworld’s solutions were able to build its own significance in the technological domain of electronic voucher distribution system and thus portrayed an ideal business model leading to prosperity and convenience. Along with the EVDS and the e-booking of transport services, it now provides a plethora of utility services to its consumers with Domestic Money Remittance, Utility Bill collections, Digital Wallets, Cash withdrawal points and Assisted e- commerce, all through one simple and user friendly application. An application which runs on desktops , laptops and mobile phones using Android, Windows, iOS & Java platforms.

A long list of brand leaders associated with Payworld holds a testament to its technological superiority of ideating, launching and helping growing successful businesses into the diverse service areas of prepaid business prospects.

Payworld has already been successful when it comes to delivering single window for all services through the interactive Electronic Platform, thereby offering a hassle-free free access to a bouquet of services, anytime anywhere. It has also focused at improving convenience to the intermediaries as well as the end-users.

Payworld services assume great significance against the backdrop of greater financial inclusion of the population especially by reaching out to the unbanked population for more and more cashless transactions to make financial inclusion task easier for the government and the users. With its’ pioneering quality, efficacy and professionalism, Payworld soon aims to enter the Global market by offering end-to-end industry-specific solutions to various overseas entrepreneurs and help them establish an ever-expanding business proposition in their respective nations and at the same time working towards strengthening its pan-India business through its proactive technological developments and timely services delivery.

A long list of brand leaders associated with Payworld holds a testament to its technological superiority of ideating, launching and helping growing successful businesses into the diverse service areas of prepaid business prospects.

Payworld has already been successful when it comes to delivering single window for all services through the interactive Electronic Platform, thereby offering a hassle-free free access to a bouquet of services, anytime anywhere. It has also focused at improving convenience to the intermediaries as well as the end-users.

Payworld services assume great significance against the backdrop of greater financial inclusion of the population especially by reaching out to the unbanked population for more and more cashless transactions to make financial inclusion task easier for the government and the users. With its’ pioneering quality, efficacy and professionalism, Payworld soon aims to enter the Global market by offering end-to-end industry-specific solutions to various overseas entrepreneurs and help them establish an ever-expanding business proposition in their respective nations and at the same time working towards strengthening its pan-India business through its proactive technological developments and timely services delivery.

In the year 2008, Payworld entered into transport reservation services (Air, Bus, and Rail). One of the pioneers in its field, Payworld has forever stood firm with its motto of “Making Life Simple”. This led to successful partnership with the governments’ National E Governance Programs. With the course of time, Payworld defined its’ niche and with that came the style of working. Soon Payworld Solutions became known for improving operator’s efficiency, generating extra revenue for the retailers and associates, and providing better and convenient services to the customers.

By end of the decade, the country was changing in a fast pace. Broadband connection where spread across the nation. But by this time a new phenomena was catching everybody’s interest. This wireless mode of communication was soon to change the entire telecommunication sector in India. It was the Mobile phone. With around 300 million wireless phone subscribers by the year 2009, there was a need to provide similar services on a mobile platform as well. And so in the early spring of 2009 Payworld launched its services on a mobile platform as well.

Payworld now stood at a position where the quality of its products and services spoke for themselves. With an outreach in about 630 cities in 23 states in India, Payworld’s solutions were able to build its own significance in the technological domain of electronic voucher distribution system and thus portrayed an ideal business model leading to prosperity and convenience. Along with the EVDS and the e-booking of transport services, it now provides a plethora of utility services to its consumers with Domestic Money Remittance, Utility Bill collections, Digital Wallets, Cash withdrawal points and Assisted e- commerce, all through one simple and user friendly application. An application which runs on desktops , laptops and mobile phones using Android, Windows, iOS & Java platforms.

In the year 2008, Payworld entered into transport reservation services (Air, Bus, and Rail). One of the pioneers in its field, Payworld has forever stood firm with its motto of “Making Life Simple”. This led to successful partnership with the governments’ National E Governance Programs. With the course of time, Payworld defined its’ niche and with that came the style of working. Soon Payworld Solutions became known for improving operator’s efficiency, generating extra revenue for the retailers and associates, and providing better and convenient services to the customers.

By end of the decade, the country was changing in a fast pace. Broadband connection where spread across the nation. But by this time a new phenomena was catching everybody’s interest. This wireless mode of communication was soon to change the entire telecommunication sector in India. It was the Mobile phone. With around 300 million wireless phone subscribers by the year 2009, there was a need to provide similar services on a mobile platform as well. And so in the early spring of 2009 Payworld launched its services on a mobile platform as well.

Payworld now stood at a position where the quality of its products and services spoke for themselves. With an outreach in about 630 cities in 23 states in India, Payworld’s solutions were able to build its own significance in the technological domain of electronic voucher distribution system and thus portrayed an ideal business model leading to prosperity and convenience. Along with the EVDS and the e-booking of transport services, it now provides a plethora of utility services to its consumers with Domestic Money Remittance, Utility Bill collections, Digital Wallets, Cash withdrawal points and Assisted e- commerce, all through one simple and user friendly application. An application which runs on desktops , laptops and mobile phones using Android, Windows, iOS & Java platforms.

A long list of brand leaders associated with Payworld holds a testament to its technological superiority of ideating, launching and helping growing successful businesses into the diverse service areas of prepaid business prospects.

Payworld has already been successful when it comes to delivering single window for all services through the interactive Electronic Platform, thereby offering a hassle-free free access to a bouquet of services, anytime anywhere. It has also focused at improving convenience to the intermediaries as well as the end-users.

Payworld services assume great significance against the backdrop of greater financial inclusion of the population especially by reaching out to the unbanked population for more and more cashless transactions to make financial inclusion task easier for the government and the users. With its’ pioneering quality, efficacy and professionalism, Payworld soon aims to enter the Global market by offering end-to-end industry-specific solutions to various overseas entrepreneurs and help them establish an ever-expanding business proposition in their respective nations and at the same time working towards strengthening its pan-India business through its proactive technological developments and timely services delivery.

A long list of brand leaders associated with Payworld holds a testament to its technological superiority of ideating, launching and helping growing successful businesses into the diverse service areas of prepaid business prospects.

Payworld has already been successful when it comes to delivering single window for all services through the interactive Electronic Platform, thereby offering a hassle-free free access to a bouquet of services, anytime anywhere. It has also focused at improving convenience to the intermediaries as well as the end-users.

Payworld services assume great significance against the backdrop of greater financial inclusion of the population especially by reaching out to the unbanked population for more and more cashless transactions to make financial inclusion task easier for the government and the users. With its’ pioneering quality, efficacy and professionalism, Payworld soon aims to enter the Global market by offering end-to-end industry-specific solutions to various overseas entrepreneurs and help them establish an ever-expanding business proposition in their respective nations and at the same time working towards strengthening its pan-India business through its proactive technological developments and timely services delivery.