Insurance for People in low income Category and the Idea Behind It!

Payworld is a customer-centric company, which has always strived to offer something novel, and something that has high value for money to the end-users, and Payworld Insurance POS is no different. So what prompted this company to foray into a field, which has more or less never existed for people from low-income strata? Well, to begin with, financial inclusion among the tier 2 /tier 3 cities is Payworld’s motto, and insurance is an integral part of financial inclusion.

Let’s just have a look at the Insurance Penetration, as far as Life and Non-life in India For the year 2016 it’s as low as 2.72 % & in Non-Life it’s merely 0.77%.These figures shows there is a huge scope for Insurance in India & also motivates companies like us to look for innovative insurance products which gives new meaning to insurance.

However, more than anything else, what encouraged the directors to take this astounding step was the fact that when it comes to people from low-income backgrounds, financial security is close to nil. Whatever income is generated on a daily, weekly or monthly basis is all used up, towards basic amenities and/or facilities like education, healthcare etc. There are absolutely no savings, whatsoever. In such a scenario, paying a hefty premium towards an insurance policy is next to impossible for these people. It is for this very reason, that Payworld worked closely with various companies offering financial products to come up with insurance products giving due consideration to the average income of the people and their needs.

Thanks to the extensive research, Payworld eventually managed to come up with special low-cost insurance plans for those people who cannot afford to pay the premiums for the other insurance plans available in the market. Moreover, Payworld is India’s leading insurance solutions provider that has the freedom to offer Life, Health as well as General Insurance, all under one umbrella. Not only does this help the people in finding the plan that best suits their needs, but also ensures that their investment offers better value for money.

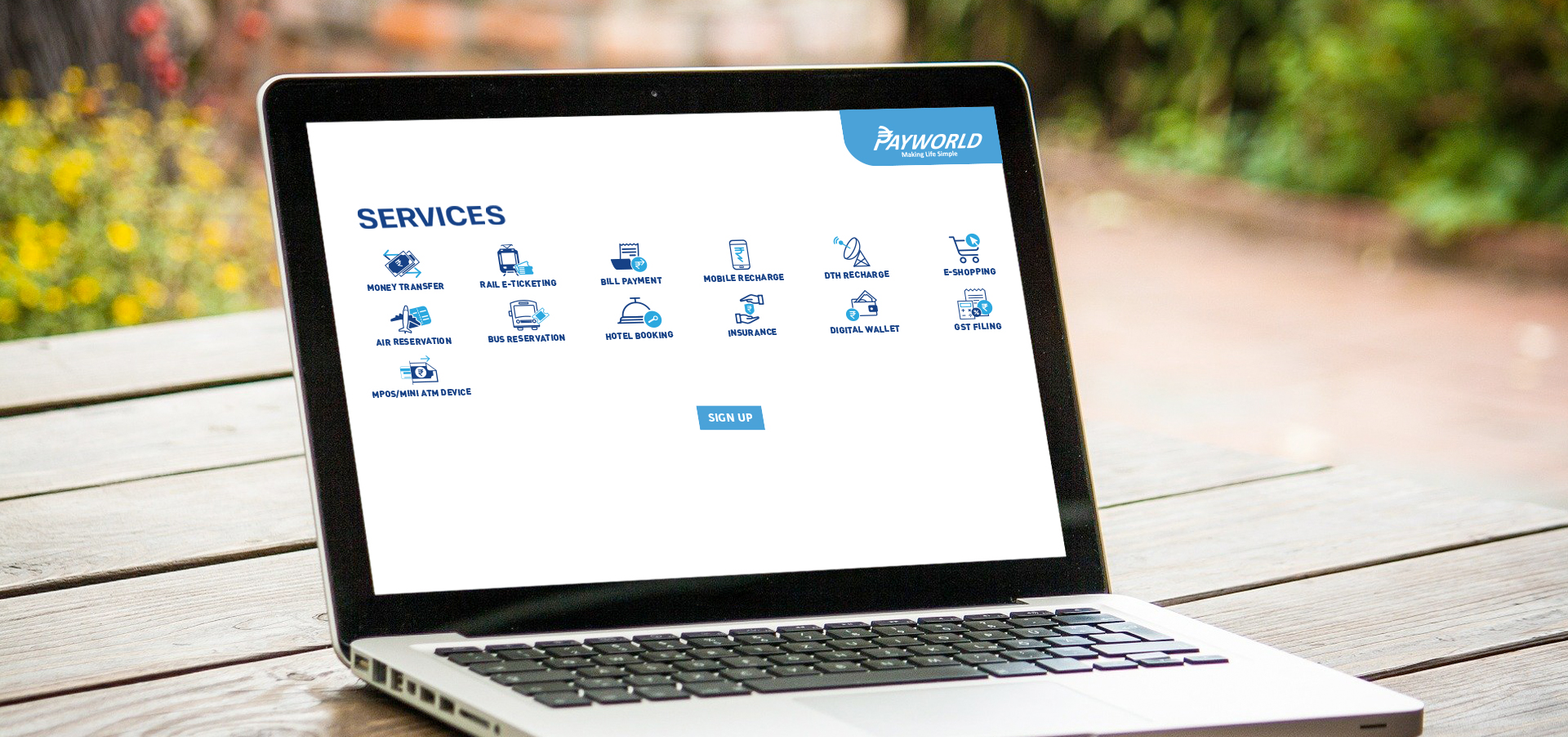

In order for this simple yet innovative idea to be accepted by the people for whom it was intended, the company extended the following services across all its Insurance Point of Sale or Insurance POS:

Easy and convenient Money transfer

Air/Rail/Bus Ticketing & Hotel Booking

Unified payment acceptance

PAN Card Application Services

Loan and utility services

However, even this did not suffice. It was then that Payworld went ahead to create informative campaigns that can help people realize the long-term benefits of insurance. Pertaining to this effort and the company’s incredible network of merchants, Payworld has managed to insure more than 12K lives in a short span of 10 months. Though the company can still be said to be in its nascent stages when it comes to offering Insurance solutions, it will surely go a long way in insuring the lives of those who are constantly working in high-risk environments and are unable to the mounting premiums. With the company’s allegiance towards offering the best of plans in the most accessible, affordable and flexible manner, the day when India’s majority low income population will be insured isn’t far away! Payworld: Retailer Signups

Thanks to the extensive research, Payworld eventually managed to come up with special low-cost insurance plans for those people who cannot afford to pay the premiums for the other insurance plans available in the market. Moreover, Payworld is India’s leading insurance solutions provider that has the freedom to offer Life, Health as well as General Insurance, all under one umbrella. Not only does this help the people in finding the plan that best suits their needs, but also ensures that their investment offers better value for money.

In order for this simple yet innovative idea to be accepted by the people for whom it was intended, the company extended the following services across all its Insurance Point of Sale or Insurance POS:

Easy and convenient Money transfer

Air/Rail/Bus Ticketing & Hotel Booking

Unified payment acceptance

PAN Card Application Services

Loan and utility services

However, even this did not suffice. It was then that Payworld went ahead to create informative campaigns that can help people realize the long-term benefits of insurance. Pertaining to this effort and the company’s incredible network of merchants, Payworld has managed to insure more than 12K lives in a short span of 10 months. Though the company can still be said to be in its nascent stages when it comes to offering Insurance solutions, it will surely go a long way in insuring the lives of those who are constantly working in high-risk environments and are unable to the mounting premiums. With the company’s allegiance towards offering the best of plans in the most accessible, affordable and flexible manner, the day when India’s majority low income population will be insured isn’t far away! Payworld: Retailer Signups