Payworld Insurance POS – An Overview

Introduction

As per a report released by the Insurance Regulatory and Development Authority of India ( IRDAI ), the penetration of life insurance in India is as low as 3.9% as against the world average of 6.3%. (Here the value of premiums is expressed as a percentage of the national GDP). Unfortunately, only about 20% of the insurable population of the nation has actually invested in one or more life insurance policies. And while the government along with the public and private sector insurance companies are taking numerous steps, they are not nearly enough.

Why aren’t Indians insured? As is the case with many other things, Indians do not take insurance as a serious matter. Only the higher strata of the society invests considerably in insurance policies, that too, primarily as a way of getting tax rebates. The lower strata of the social-economic classes, do not always have the disposable income required to pay insurance premiums, and hence, end up staying uninsured.

What does this situation entail?

Unfortunately, the situation is graver than it appears to be. The lower-middle and the lower class involves families which are essentially dependent on the income of one earning member. Moreover, these socioeconomic classes, do not have any significant assets such as property, gold or even savings. This implies, that in case, the earning member passes away in an unforeseen manner, there is little to no chances of the family recovering from the impact.

In order to rectify the situation, the only alternative that the people can and should turn to is Life Insurance. No matter the extent of coverage or the benefits, once insured, a person can always rest assured of the fact that his/her family will have at least some financial support so that they can recover from the impact in an effortless manner.

Payworld Insurance POS to the rescue

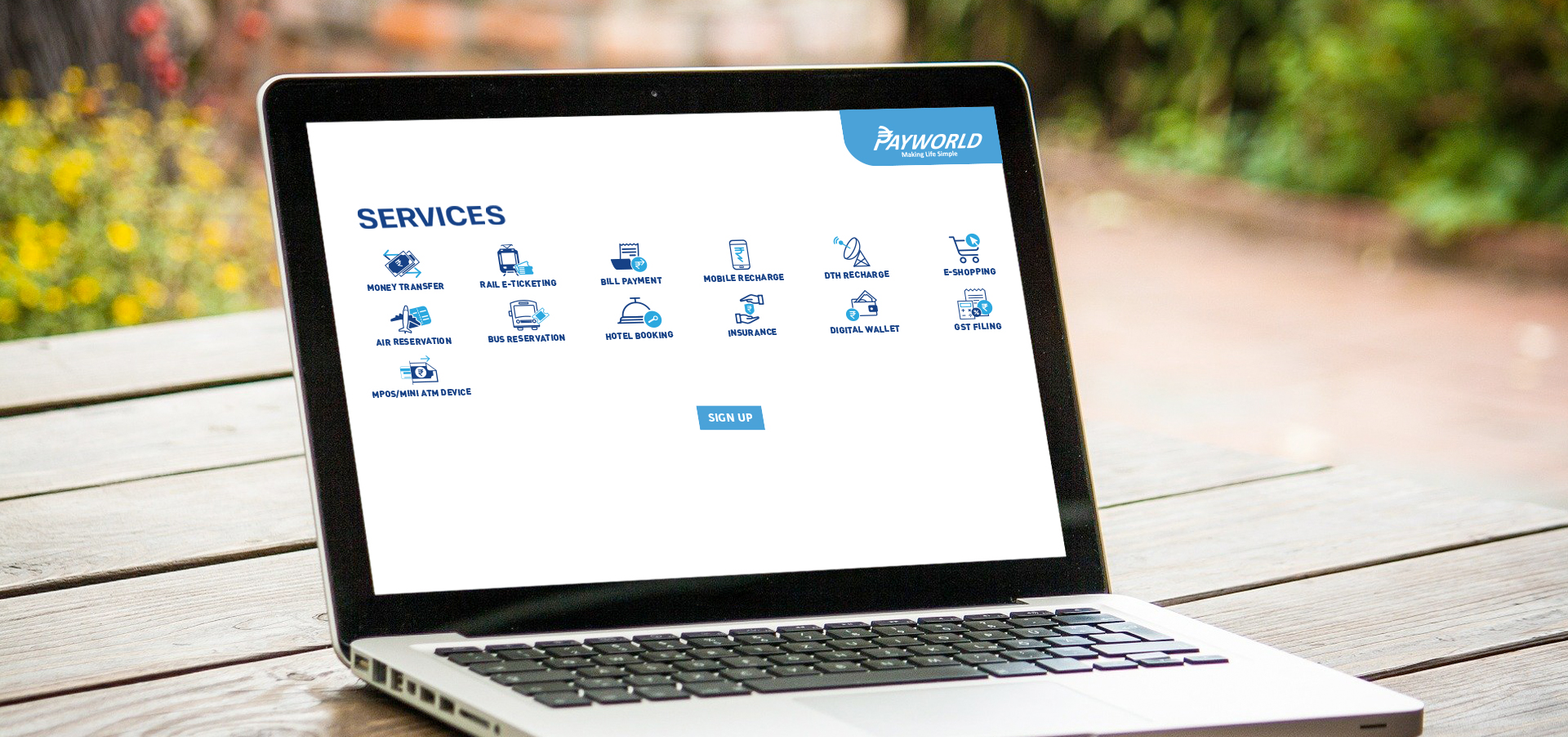

Payworld is a Composite Corporate Agent and is hence authorized to offer insurance solutions pertaining to Life, Health, and General, all across India. Owing to its motto of ‘Financial Inclusion amongst Tier 2 and Tier 3 cities in India’, the company has designed certain specialized products for customers who cannot afford high premiums.

In order to make these insurance products readily available to the end customers, Payworld relies on its incredible network of over 1 lakh retailers across India, some of which act as the Insurance Point of Sale or Insurance POS.

Look for a nearest Payworld retailer or ask us about your nearest Insurance POS and get insured. Payworld also urges people who are reading this blog to create awareness about the offerings among people who are in need of such policies.

As per a report released by the Insurance Regulatory and Development Authority of India ( IRDAI ), the penetration of life insurance in India is as low as 3.9% as against the world average of 6.3%. (Here the value of premiums is expressed as a percentage of the national GDP). Unfortunately, only about 20% of the insurable population of the nation has actually invested in one or more life insurance policies. And while the government along with the public and private sector insurance companies are taking numerous steps, they are not nearly enough.

Why aren’t Indians insured? As is the case with many other things, Indians do not take insurance as a serious matter. Only the higher strata of the society invests considerably in insurance policies, that too, primarily as a way of getting tax rebates. The lower strata of the social-economic classes, do not always have the disposable income required to pay insurance premiums, and hence, end up staying uninsured.

What does this situation entail?

Unfortunately, the situation is graver than it appears to be. The lower-middle and the lower class involves families which are essentially dependent on the income of one earning member. Moreover, these socioeconomic classes, do not have any significant assets such as property, gold or even savings. This implies, that in case, the earning member passes away in an unforeseen manner, there is little to no chances of the family recovering from the impact.

In order to rectify the situation, the only alternative that the people can and should turn to is Life Insurance. No matter the extent of coverage or the benefits, once insured, a person can always rest assured of the fact that his/her family will have at least some financial support so that they can recover from the impact in an effortless manner.

Payworld Insurance POS to the rescue

Payworld is a Composite Corporate Agent and is hence authorized to offer insurance solutions pertaining to Life, Health, and General, all across India. Owing to its motto of ‘Financial Inclusion amongst Tier 2 and Tier 3 cities in India’, the company has designed certain specialized products for customers who cannot afford high premiums.

In order to make these insurance products readily available to the end customers, Payworld relies on its incredible network of over 1 lakh retailers across India, some of which act as the Insurance Point of Sale or Insurance POS.

Look for a nearest Payworld retailer or ask us about your nearest Insurance POS and get insured. Payworld also urges people who are reading this blog to create awareness about the offerings among people who are in need of such policies.